2025 China corporate payment survey: Longer payment terms helped mitigate increases in payment delays

- Written by Viw Magazine

HONG KONG SAR - Media OutReach Newswire - 1 April 2025 - Coface's survey on Chinese corporate payment behavior shows growing caution among suppliers to offer credit sales and extended collection period in 2024.

- Companies generally extended their payment terms, aided in part by third-party risk mitigation tools that may provide some comfort for suppliers to accommodate client needs.

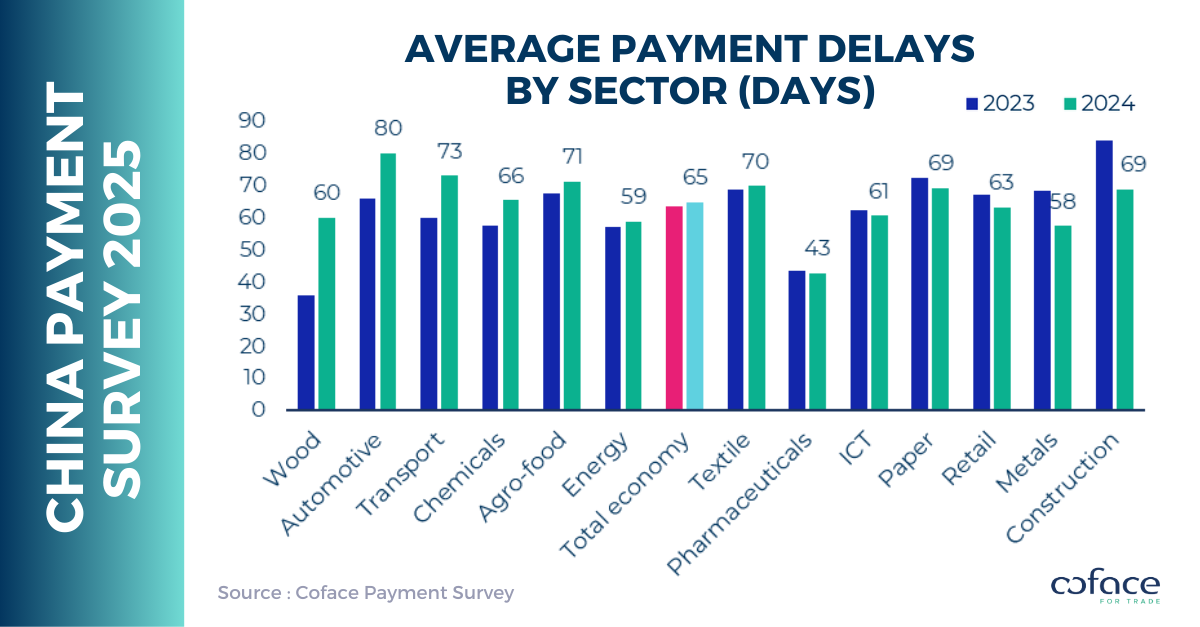

- Longer payment terms have mitigated increases in payment delays, which rose only slightly from 64 days to 65 days.

- However, if payment delays are added to payment terms, the total average waiting time between product delivery and payment collection increased from 133 days in 2023 to 141 days in 2024.

- Among respondents that experienced ultra-long payment delays (ULPDs, above 180 days), almost half reported late payment worth at more than 2% of annual turnover. This proportion was significantly up from 33% in 2023 and implied a rise in non-payment risk.

Junyu Tan, North Asia Economist at Coface, says: "The collection period for Chinese suppliers lengthened in 2024, due to declining corporate revenues, driven by slower volume growth amid sluggish domestic demand but also by price pressures in an ongoing deflationary environment. While suppliers extended payment terms on average, growing caution was evident as fewer companies offered credit sales. Looking ahead to 2025, 52% of our respondents expected the economic outlook to improve as government stimulus efforts may have bolstered confidence among companies. However, this optimism could be overstated, as stimulus measures have been relatively restrained so far, and tariff risks for trade sectors remain a looming challenge. Coface expects China's GDP growth to stand at 4.3% in 2025."

Payment delays[1]: Increasing ultra-long payment delays

Companies generally extended payment terms in 2024, aided in part by third-party risk mitigation tools. The average total payment terms increased from 70 days in 2023 to 76 days in 2024. Thanks to these more generous terms, payment delays remained relatively stable, rising only slightly from 64 days to 65 days. However, if payment delays are added to payment terms, the total average waiting time between product delivery and payment collection, known as days sales outstanding (DSO), increased from 133 days in 2023 to 141 days in 2024, indicating an extended collection period from a year ago.

The share of respondents reporting past dues considerably reduced from 62% in 2023 to 44% in 2024. The duration of delays also remained stable. However, when combined with longer payment terms, the average days sales outstanding (DSO) rose from 133 days in 2023 to 141 days in 2024, indicating extended collection periods.

Meanwhile, among respondents that experienced ultra-long payment delays (ULPDs, above 180 days), 50% reported late payment worth more than 2% of annual turnover. This proportion was significantly up from 33% in 2023 and implied a rise in non-payment risk. Based on Coface's practical experience, 80% of such delays, above 180 days and exceeding 2% of suppliers' annual turnover, were not able to be collected.

By sector, the wood industry has experienced the most significant extension in payment delays, primarily driven by the prolonged housing market crisis that suppressed furniture demand and led to a significantly longer settlement cycle for the sector. Meanwhile, the automotive sector faced similar challenges. This was largely attributed to the financial burden on car dealers, who were grappling with losses and capital constraints amid an ongoing discount war aimed at reducing inventory. The construction industry continued to have one of the longest DSO in the survey, reflecting persistently tight liquidity conditions for the downstream.

Economic expectations: Competition to remain intense amid persisting overcapacity pressure

Respondents remained optimistic about the economic outlook over the next 12 months, with 52% expecting business conditions to improve in 2025. Pharmaceuticals remained the most optimistic industry (83%), driven by structural demand from an aging population. Metals ranked second in optimism (72%), likely fuelled by hopes for stimulus measures. Yet, this sentiment may be excessive, as muted demand from the housing construction sector may continue to weigh on real demand. Additionally, rising tariffs between the U.S. and China could exacerbate challenges for metals like steel and aluminium that are subject to higher tariffs. Textiles remained the most pessimistic sector, though fewer respondents expected the outlook to worsen compared to last year, as textile firms may find some relief from moderating raw material costs, with prices for cotton and oil expected to trend lower.

Fierce competition remained the top risk facing corporate operations in 2025, highlighting the persistent challenge of China's excessive production capacity. Slowing demand ranked as the second-largest risk, particularly for export-oriented firms, which could face heightened trade barriers under a second Trump presidency. It remained unclear whether government efforts to stimulate domestic demand would be sufficient to offset the shortfall in external demand. The sustained gap between supply and demand is likely to push Chinese companies to continue engaging in price competition to drive sales, further intensifying market pressures.

Hashtag: #Coface

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

As a global leading player in trade credit risk management for more than 75 years, Coface helps companies grow and navigate in an uncertain and volatile environment.

Whatever their size, location or sector, Coface provides 100,000 clients across some 200 markets. with a full range of solutions: Trade Credit Insurance, Business Information, Debt Collection, Single Risk insurance, Surety Bonds, Factoring. Every day, Coface leverages its unique expertise and cutting-edge technology to make trade happen, in both domestic and export markets. In 2024, Coface employed ~5 236 people and recorded a turnover of ~€1.84 billion.

For more information, visit coface.com.hk